After a decline in the first half of 2024, electronics sales recovered in the third quarter of 2024 and rose by 8% compared to the previous quarter, with a 20% quarter-on-quarter increase forecast for the fourth quarter of 2024. IC sales also rose by 12% in the third quarter of 2024 compared to the previous quarter and are expected to increase by a further 10% in the fourth quarter of 2024. Overall, IC sales are forecast to increase by over 20% in 2024, mainly driven by memory products benefiting from general price increases and strong demand for data center memory chips.

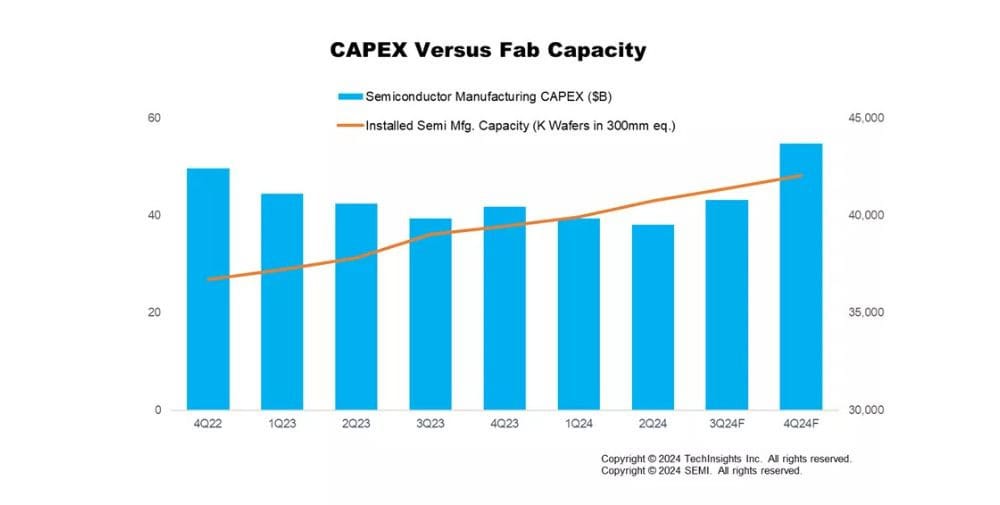

Similar to electronics sales, investments in semiconductors (CapEx) declined in the first half of 2024, but the trend turns positive from the third quarter of 2024 onwards. Investments in memory-related CapEx increase by 34% in the third quarter of 2024 compared to the previous quarter and by 67% compared to the previous year, reflecting the improvement in the market for memory ICs compared to the same period of the previous year. In the fourth quarter of 2024, total capex is expected to increase 27% quarter-over-quarter and 31% year-over-year, with memory-related capex leading this growth at 39% year-over-year.

The semiconductor capital equipment segment continues to be strong and is performing better than expected due to significant investment from China and higher spending on high-bandwidth memory and advanced packaging. Spending on wafer fab equipment (WFE) increased by 15% year-on-year and 11% quarter-on-quarter in the third quarter of 2024. China’s investments continue to play a significant role in the WFE market. In addition, both the test and assembly and packaging segments recorded impressive year-on-year growth of 40% and 31% respectively in Q3 2024, and this growth is expected to continue for the remainder of the year.

In the third quarter of 2024, installed wafer fab capacity reached 41.4 million wafers per quarter (in 300mm wafer equivalent) and is expected to increase by 1.6% in the fourth quarter of 2024. Capacity related to foundry and logic continues to show stronger growth, increasing by 2.0% in Q3 2024. An increase of 2.2% is forecast for Q4 2024, which is attributable to the capacity expansion for both advanced and mature nodes. Storage capacity increased by 0.6% in the third quarter of 2024 and is expected to maintain the same pace of growth in the fourth quarter of 2024. This growth is driven by strong demand for high bandwidth memory (HBM), but is partially offset by process node transitions.

“The semiconductor capital equipment segment continues to exhibit growth momentum, supported this year by strong investment from China and increased spending on advanced technologies,” said Clark Tseng, senior director of market intelligence at SEMI. “In addition, the continued expansion of fab capacity, particularly in the foundry and logic segments, underscores the industry’s commitment to meeting the growing demand for advanced semiconductor technologies.”

“2024 has shown two sides of the semiconductor industry,” said Boris Metodiev, Director of Market Analysis at TechInsights. ‘While the consumer, automotive and industrial markets have struggled, AI has performed well, driving up average selling prices for memory and logic products. As interest rates decline through 2025, consumer sentiment is expected to improve, encouraging larger purchases and supporting both the consumer and automotive markets.’

The Semiconductor Manufacturing Monitor (SMM) report provides comprehensive data on the global semiconductor industry. The report highlights key trends based on industry indicators such as capital equipment, manufacturing capacity, and semiconductor and electronics sales, and includes a forecast for the capital equipment market. The SMM report also includes two years of quarterly data and a quarterly outlook for the semiconductor manufacturing supply chain, including leading IDM, fabless, foundry and OSAT companies. An SMM subscription includes quarterly reports.

About SEMI

SEMI® is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide in the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration in finding solutions to the industry’s greatest challenges through advocacy, workforce development, sustainability, supply chain management and other programs. Our SEMICON® exhibitions and events, technology communities, standards and market intelligence help drive our members’ business growth and innovation in design, devices, equipment, materials, services and software, enabling smarter, faster and safer electronics.

– – – – – –

Further links

👉 www.semi.org

👉 Semiconductor Manufacturing Monitor

Graphic: SEMI (www.semi.org) and TechInsights (www.techinsights.com), November 2024