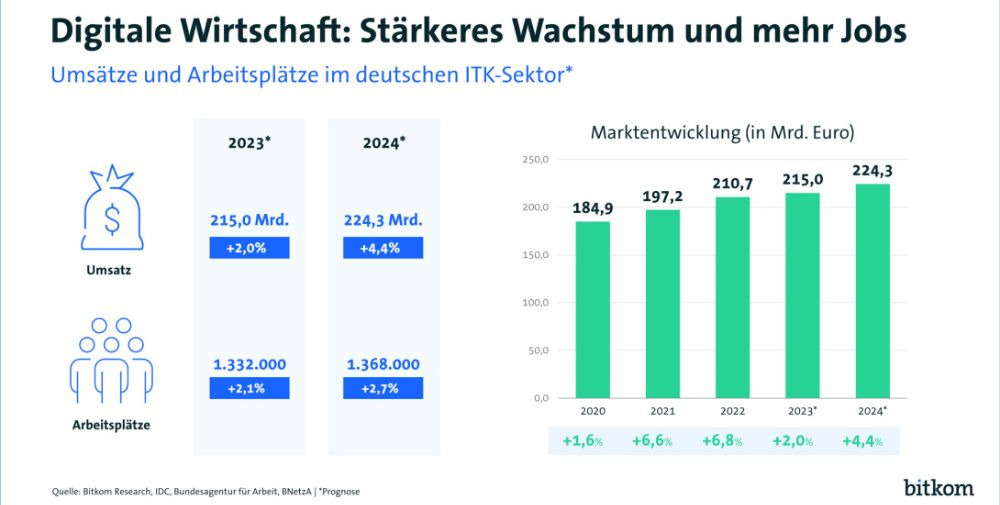

“Most companies in the Bitkom sector are resilient to the crisis. Even under difficult economic conditions, characterized by geopolitical crises and budget cuts, sales and employment are increasing. Job growth in particular could be significantly higher, with the shortage of skilled workers proving to be a stumbling block,” says Bitkom President Dr. Ralf Wintergerst. “Digitalization is the answer to the current challenges facing the economy, society and the state. Our resolution for 2024 must be: More determination in digitalization and more freedom for innovation.”

Every fifth digital company wants to increase investments

The business climate in the digital economy is developing positively, bucking the trend in the economy as a whole, as the Digital Index compiled by Bitkom and the ifo Institute shows. While the ifo index for the economy as a whole fell from minus 9.4 points to minus 11.2 points in December, the digital index rose from 6.0 to 9.8 points. The positive development is also reflected in the investment plans of ICT companies. For example, 22% want to increase their investments in 2024 and 61% want to keep spending constant, while 17% will have to put on the brakes. Investments will primarily be made in software and research and development. “The Bitkom sector is starting the new year with confidence. With its solutions, it brings efficiency and productivity gains for companies and creates a positive mood. Germany’s economy needs both of these things more urgently than ever before,” says Wintergerst.

IT drives industry growth

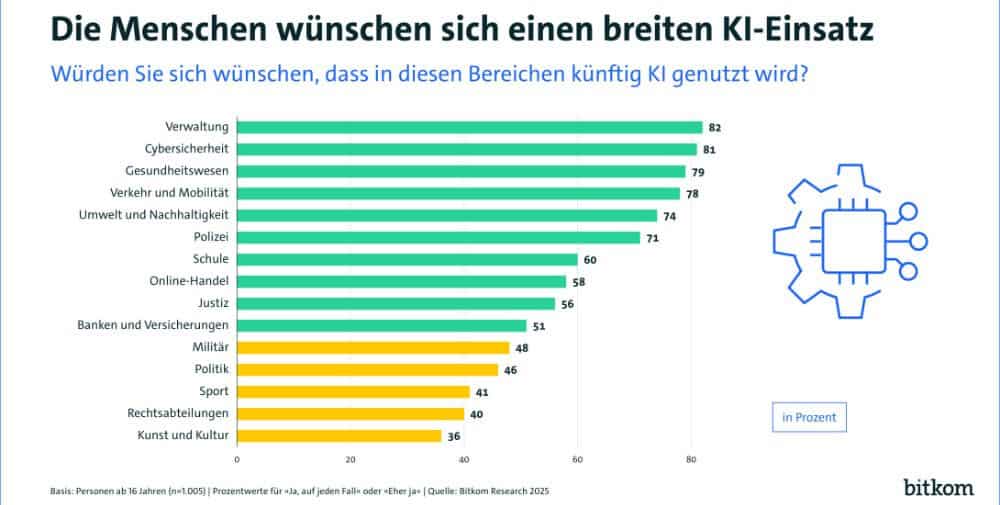

Information technology is the most important growth driver. After a slight dip in growth last year (up 2.2% to 142.9 billion euros), the current forecast predicts a turnover of 151.5 billion euros in 2024, which corresponds to an increase of 6.1%. The software business in particular is growing strongly (up 9.4% to EUR 45.5 billion). Sales of platforms for the development, testing and provision of software grew at an above-average rate of 12.3% to EUR 12.2 billion. This also reflects the current boom in artificial intelligence. Business with AI platforms grew by 38.3% to EUR 1.4 billion. “Artificial intelligence will remain the hot topic in 2024. Companies should get to grips with AI now, set up corresponding projects and also invest in the technology,” says Wintergerst. “Politicians must show a sense of proportion when implementing the AI Act and ensure that AI can continue to be used and developed in Germany and Europe.”

The business with software for companies’ system infrastructure can also grow significantly. Turnover in this segment is expected to increase by 8.1% to 10.0 billion euros. Security software accounts for a share of 3.9 billion euros, which corresponds to an increase of 12.7%. Sales of other software applications are also growing strongly, increasing by 8.5% to EUR 23.2 billion. This includes collaboration tools for collaboration and mobile working, which are growing at an above-average rate of 13.5% to EUR 1.6 billion.

According to Bitkom, revenue from IT services will increase by 4.8% to EUR 51.7 billion in 2024. Cloud-related services are growing particularly strongly, accounting for 17.7 billion euros of the total IT services market and increasing by 17%. Wintergerst: “The overall strong IT growth shows that the German economy is taking digitalization seriously. The willingness to invest remains high even under difficult conditions.”

Hardware business picks up significantly again

After a slump last year (down 5.4% to EUR 52.0 billion), the market for IT hardware has returned to significant growth and is expected to increase by 4.6% to EUR 54.4 billion in 2024. The Infrastructure-as-Service segment, i.e. rented servers, network and storage capacities, remains the biggest growth driver, increasing by 24.5% to EUR 5.8 billion. Sales of workstations (up 17.8% to EUR 1.0 billion) and wearables (up 15.7% to EUR 2.9 billion) also saw double-digit growth. The PC business is recovering, increasing by 4.2% to 7.9 billion euros. In contrast, sales of security technologies fell below the zero line, declining by 1.5% to EUR 1.1 billion after several years of strong growth. “The hardware business is gradually normalizing to pre-corona levels – we saw a very strong increase in demand at the start of the pandemic and then a significant slump in the previous year. However, the uncertainties remain high, also with regard to supply chains,” says Wintergerst. “Under no circumstances should we cut back on IT security. The threat situation in cyberspace has intensified.”

Consumer electronics continues to shrink

For the fourth year in a row, the classic consumer electronics business has recorded a decline. After a drop of 2.1 percent to 8.1 billion euros last year, Bitkom expects a further decline in sales of 3.4 percent to 7.8 billion euros in 2024. “Traditional consumer electronics are still struggling. The industry is at least hoping for a slight European Football Championship effect for televisions,” says Wintergerst. Bitkom does not expect any special effect from new console generations in the games console business this year.

Telecommunications remains stable overall

In the telecommunications market, Bitkom expects growth of 1.0% to EUR 72.8 billion in 2024. The largest share of this will come from the telecommunications services business, which will account for EUR 52.6 billion (up 1.6%). Investments in telecommunications infrastructure fell slightly by 1.0% to EUR 8.4 billion, although there are significant differences in this segment. For example, spending on Ethernet switches (down 10.0% to EUR 1.8 billion) and IP PBX, i.e. Voice-over-IP telephony (down 8.6% to EUR 0.2 billion) shrank significantly. In contrast, investments in access infrastructure are increasing, both wired (up 7.0% to EUR 0.7 billion) and mobile (up 6.2% to EUR 1.2 billion). At minus 0.2% to EUR 11.8 billion, sales of end devices remained at the previous year’s level. “Investments in the expansion of fixed and mobile networks remain high,” says Wintergerst. “However, the growth potential for telecommunications services is limited due to fierce price and infrastructure competition.”

Germany continues to grow only slowly in a global comparison

According to the forecast, global IT and telecommunications sales will increase by 5.6% to 4.91 trillion euros in 2024. India will record the highest growth with an increase of 7.9 percent, followed by the USA (6.3 percent), China (5.7 percent), the UK (5.6 percent) and Japan (3.5 percent). The EU, excluding Germany, achieved growth of 5.9%.

In terms of global market share, the USA was able to expand its dominant position and now has 38.0%. China (11.4 percent), Japan (4.8 percent) and the UK (4.3 percent) follow far behind. Germany is only in fifth place with 4.0%, while India has a global market share of 2.5%. The EU, excluding Germany, accounts for 10.8% of global ICT expenditure. “In order for Germany to catch up in terms of digitalization, companies and administrations must increase their investments more decisively,” says Wintergerst. Wintergerst is calling on the German government to put the economy and growth at the heart of its policies and to step up the pace of digitalization. Wintergerst: “Economic performance and competitiveness require digital infrastructures, digitalized administrations and digitalized companies. The traffic light coalition has set itself the task of driving digitalization forward. However, the federal government has only completed 60 of the 334 digital policy projects in this legislative period, 226 are being implemented and 48 have not yet been started. If the federal government continues at the current pace, it will only complete every second digital project by the next election. The pace of digital policy must be more than doubled.” This is also urgently needed to strengthen Germany’s digital sovereignty and increase protection in cyberspace.

– – – – – –

Further links

👉 www.bitkom.org

Graphic: Bitkom